The best part of a business is getting new customers – right?

But if you want to ensure sustainable growth, you’ve also got to pay attention to your Customer Acquisition Cost or CAC.

When we start a business, we usually focus on bringing in as many customers as possible. But not paying enough attention to CAC can slow down your growth. Even if you’re making good sales, you might not end up with your expected profit.

Customer Acquisition Cost is the total cost of gaining a new customer in a specific timeframe. It covers sales, marketing expenses, salaries, commissions, bonuses, and overhead tied to attracting and converting leads.

In this post, I will explain-

- Customer Acquisition Cost for SaaS

- Customer Acquisition Cost Formula

- How to calculate and measure CAC effectively

- 11 actionable tips to reduce CAC

Let’s just dive in…

What is Customer Acquisition Cost

At its core, Customer Acquisition Cost is the total amount you spend to get a new customer. This includes all your marketing and sales budget, employee salaries, creative efforts, technical work, tools, and even managing inventory.

Essentially, CAC is the price you pay to bring in new customers.

The cost of acquiring new customers is on the rise. Recent studies show that brands are hemorrhaging an average of $29 for each fresh face they bring in. The cost of customer acquisition has surged by a whopping 60%.

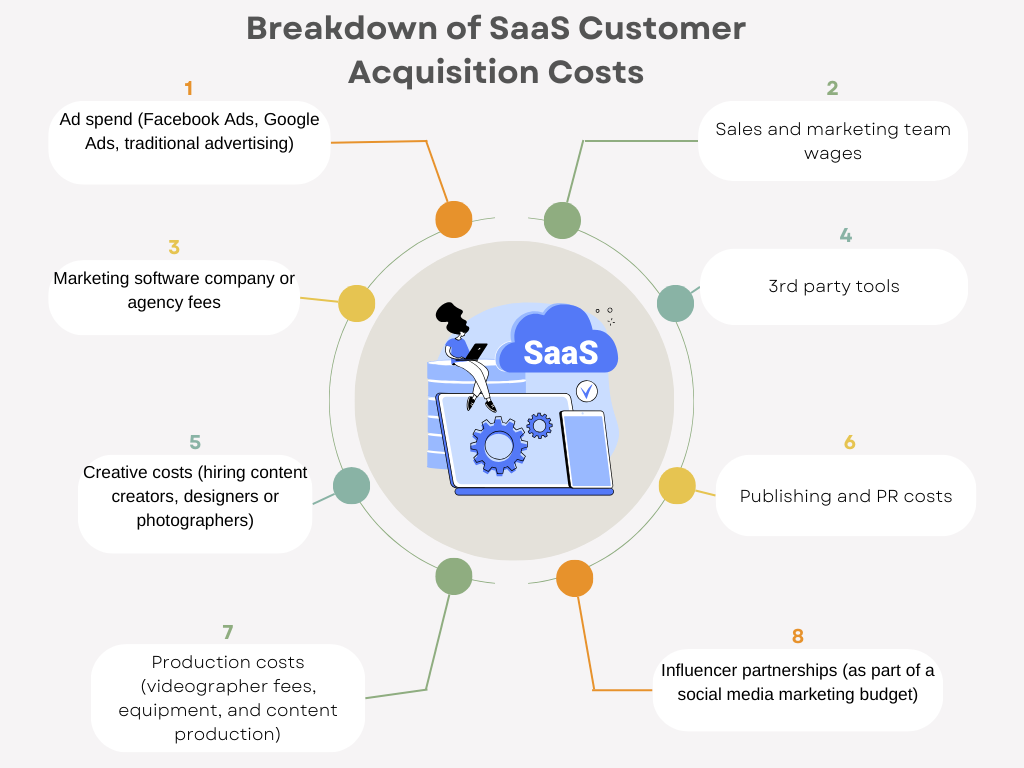

This graphic shows the focus areas you spend on to get new customers-

The lower CAC is a sign of healthier profit margins. This results in better value for your customers and a more competitive position in the market.

Reducing CAC isn’t just about saving money – it’s a sign of a healthy business.

Successful companies work to reduce their CAC – showcasing the effectiveness of their sales, marketing, and customer service strategies

Why Tracking CAC is Crucial for SaaS Enterprises and Startups

For startups, especially Software as a Service (SaaS) enterprises, understanding CAC isn’t just a choice – it’s a necessity.

CAC acts as the guiding compass toward efficient and profitable customer acquisition.

Tracking CAC is like having a roadmap for SaaS companies.

It helps you fine-tune your strategies, make the most of your marketing budget, and ensure steady and long-lasting growth.

How to Calculate Customer Acquisition Cost – Get CAC Formula with Example

Calculating CAC is quite easy.

You should mainly follow below three steps-

- Select a time frame, such as a month, quarter, or year

- Add all the costs of acquiring customers during that period

- Count the total number of new customers you’ve gained within your selected timeframe

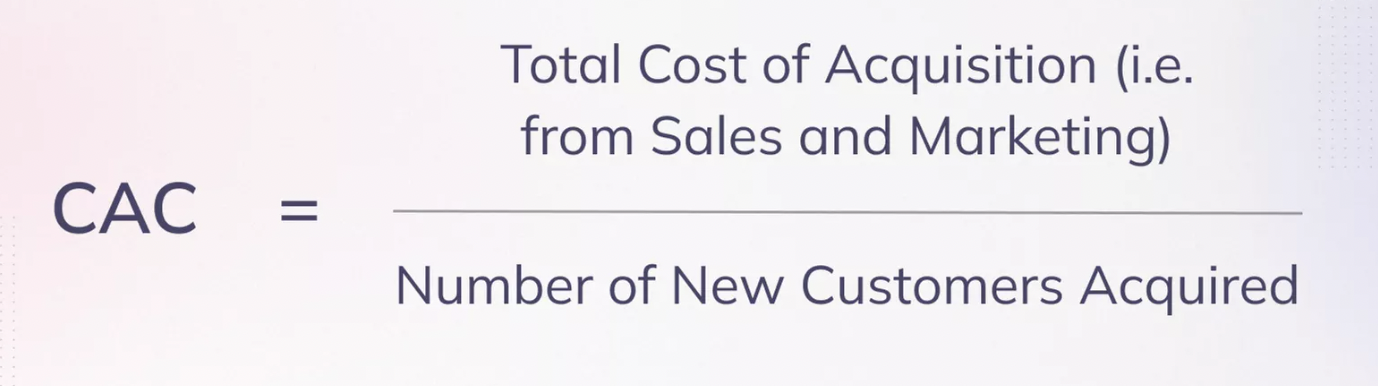

Now, use the customer acquisition cost or CAC formula to get your CAC-

CAC = Total Acquisition Costs / Number of New Customers Acquired

For example, if you spend $100 on marketing in a year and gain 100 customers, your CAC is $1.00.

It’s easy – isn’t it?

But yes, things can get tricky when your marketing investments don’t lead to immediate results. This only happens when your average sales cycle is too long. In such cases, you need to try different approaches to get a clearer view of your CAC.

Let’s say you invest $500 in a quarter but acquire only 50 customers. Your CAC for that period would be $10. But you can get more customers in the next quarter with the same spending. Inbound Marketing strategies work just like that. You invest once but get results for months or even years.

It’s like finding the missing piece of a puzzle to optimize your customer acquisition strategy.

Getting confused?… Don’t worry, we will explain the sales cycle later in this post in detail.

What is a Good Customer Acquisition Rate for SaaS and Tech Industry

3:1 or 4:1 is considered as the Good Customer Acquisition Rate for SaaS but you know there’s no certain number or percentage for CAC.

The goal here is to keep your CAC significantly lower than your Customer Lifetime Value (LTV). I mean generating more revenue from each customer with less spending throughout his/her engagement with your business. Like generating $4 to $10 or even more from each customer by spending $1 to acquire him/her.

Let’s explain the scenario-

- CAC (Customer Acquisition Cost) is what you spend to acquire a new customer.

- LTV (Customer Lifetime Value) measures the total value that a customer brings throughout the relationship.

The sweet spot is having your CAC around one-third or one-fourth of your LTV. This creates a strong LTV to CAC ratio of 3:1 or 4:1.

Note: LTV is a separate metric but it’s closely related to CAC. Understanding the lifetime value of a customer helps measure the long-term ROI of your acquisition efforts. A high LTV:CAC ratio indicates a healthy customer acquisition strategy.

What does LTV:CAC ratio mean for you?

The LTV:CAC ratio ensures that the revenue you generate from a customer is higher than what you spend to acquire them. You can easily calculate your LTV: CAC ratio by dividing your LTV by your CAC.

Check the formula below-

LTV:CAC Ratio = Customer Lifetime Value (LTV)/Customer Acquisition Cost (CAC)

Check an example on this formula-

If your CAC is $1,000, your LTV:CAC ratio would look like this:

LTV:CAC Ratio = $4,000 (LTV) / $1,000 (CAC) = 4:1

This means that for every $1 you spend acquiring a customer, you’re getting $4 in return throughout your relationship with that customer.

It’s a solid strategy for building profitable customer relationships in the SaaS and tech startup world.

Differentiating between Customer Acquisition Cost and Customer Lifetime Value (CAC vs LTV)

Still confused with CAC vs LTV? Let’s simplify the differentiation between CAC and LTV.

CAC (Customer Acquisition Cost) is the total investment to get a new customer. Think of it as the price tag for bringing them in. It matters because it guides your profitability and efficiency.

LTV (Customer Lifetime Value) is the total revenue you expect from a customer during their journey with your business. It matters because it helps you evaluate their long-term value.

Here’s a short table to help you grasp this essential dynamic:

| Metric | Definition | Why matters |

| Customer Acquisition Cost (CAC) | Total investment to acquire a customer | Guides profitability and efficiency |

| Customer Lifetime Value (LTV) | Predicted total revenue from a customer | Evaluates long-term value |

Let’s get an example to illustrate the relationship between CAC and LTV.

Customer Acquisition Cost (CAC): Imagine you run an e-commerce store. In January, you spend $1,000 on marketing efforts to acquire new customers. During that same month January, you managed to attract 100 new customers to your online store.

Customer Lifetime Value (LTV): On average, each customer you acquire in January generates $500 in revenue for your business over a year.

Now, let’s calculate the CAC and LTV:

- CAC = Total Marketing Spend / Number of New Customers Acquired

- CAC = $1,000 / 100 customers

- CAC = $10 per customer

So, your Customer Acquisition Cost (CAC) is $10 for each new customer you bring in.

LTV = Average Revenue per Customer x Average Customer Lifespan

- LTV = $500 x 1 year

- LTV = $500 per customer

The Customer Lifetime Value (LTV) for each customer is $500.

In this scenario, your CAC is $10, and your LTV is $500.

This means you are spending $10 to acquire a customer who, on average, will bring in $500 in revenue over their lifetime. This is a profitable customer relationship for your business.

Also, this is a positive sign for your business. Ideally, you want your CAC to be significantly lower than your LTV. To check if your CAC is good, just compare it to your LTV.

Top Factors Impacting Your Customer Acquisition Cost

In this section, I’ll break down Customer Acquisition Cost (CAC) in detail. Let’s explore the key factors affecting your CAC, from marketing channels to sales strategies. Get a clear roadmap to understanding this metric.

Here are the three key points we’ve explained-

- Marketing Channels and Strategies

- 3 additional factors influencing your CAC

- Complications in Calculating CAC Due to Long Sales Cycles

Now let’s dive into details-

Marketing Channels and Sales Efforts

Understanding CAC involves a thorough examination of various cost components. These elements encompass everything from marketing channels to sales efforts.

Paid Advertising (Search Ads, Social Media, Retargeting Campaigns)

Paid advertising forms the backbone of many customer acquisition strategies. It encompasses expenses incurred through Google ads or other search ads, social media promotions, paid partnerships, and other platforms designed to capture the attention of potential customers.

It’s important to note that CAC isn’t solely about your ad spend; it’s also about the effectiveness of these campaigns in transforming leads into paying customers.

You know- wrong strategy and poor optimization can cost you more than average.

Content Marketing

Content is the cornerstone of digital marketing and plays a key role in succession. Blogs, videos, and other forms of content serve as the most effective tools for attracting prospects to your SaaS solutions.

Content is about creating engaging, informative, and value-driven material that resonates with your target audience. Content includes product documentation, blogging, video tutorials, lead generation materials like ebooks, white papers, and more related to product branding and promotion.

With proper topical mapping, quick production, and repurposing, you can significantly reduce your costs and get sustainable organic growth.

Referral Programs

Referral programs have the potential to be game-changers in SaaS customer acquisition. Encouraging existing users to refer your product to others can yield remarkable results.

Also, you can invite top affiliate marketers to review your tools or services.

The key to success lies in crafting an effective referral marketing strategy and offering appropriate incentives.

Sales Team Size and Efficiency

The size and efficiency of your sales team significantly influence your CAC. An organized, productive sales force leads to more effective customer acquisition.

Conversely, an inorganized, excessively large, or inefficient team can inflate costs without bringing desired results.

We see even big companies make mistakes with team efficiency and productivity. Here’s a scenario-

If you hire potential content writers and train them properly or directly hire expert resources who can research, write, proofread, and optimize their written posts on their own. Your editor should just take a final look to ensure the desired quality and value and click on the publish button.

But if you hire average-quality writers and let them write only on Google docs. Assign another team of editors and SEOs to proofread and optimize those same posts separately; you’re just wasting your time and money. In such cases, both the production and quality do not meet the expected standard most of the time.

You need to be very careful with your team’s learning, productivity, and efficiency to win the CAC game.

Sales Processes and Automation

Efficient sales processes combined with automation (or powered by AI tools) will transform your business.

Streamline your sales team’s work and automate repetitive tasks to significantly reduce your CAC and enhance your overall customer acquisition experience.

Try to utilize project management, CRM, and email marketing automation tools from your first day.

3 Additional Factors Influencing Your CAC

Beyond marketing and sales, there are some additional factors that can influence your CAC. Check a few of them-

Product Complexity: The complexity of your SaaS product will impact CAC for sure. Products requiring extensive education, testing, and support result in higher acquisition costs. Try to develop user-friendly and intuitive products that will keep your CAC in check. Product-led growth is your key.

Competitive Environment: The level of competition in your niche matters. In highly competitive markets, you need to invest more in marketing and sales efforts to stand out. Analyze your competitors to find opportunities for cost-effective customer acquisition.

Customer Segmentation: Segmenting your target audience allows for more efficient marketing. If you can reach out to your target audience groups from the beginning, you will surely get higher conversion rates with lower acquisition costs.

Complications in Calculating CAC Due to Long Sales Cycles

Long sales cycles can make calculating your CAC tricky. Each industry has an average sales cycle, you should find out your one to get the actual CAC with ease.

Let’s say you run a SaaS startup, and it typically takes 12 months to convert a lead into a paying customer. When you spend money on sales and marketing today, you might not see immediate results. It could take a year or more to acquire that customer.

To deal with this situation, you should consider extending the time you use to calculate your CAC.

If your sales cycle is 12 months, calculate CAC over a two-year period. This helps align your expenses with the customers you eventually gain, giving you a better understanding of your long-term customer acquisition costs.

Average Customer Acquisition Cost for SaaS Industries

Here are the top 15 SaaS industries and their average Customer Acquisition Costs (CAC). This list by firstpagesage highlights the SaaS industries with higher CAC values-

- Fintech: $1,450

- Insurance: $1,280

- Medtech: $921

- Hospitality: $907

- Project Management: $891

- Education: $806

- Security: $805

- Agtech: $712

- Telecommunications: $694

- Cleantech: $674

- Building Management & IoT: $574

- Industrial: $542

- Proptech: $518

- Transportation & Logistics: $483

- Staffing & HR: $410

How to Reduce Customer Acquisition Cost (11 Strategies to follow in 2024)

I have already shared a few tips and hacks to optimize your CAC above. Time to get a comprehensive list.

Let’s Explore 11 actionable strategies to optimize your Customer Acquisition Cost and ensure sustainable growth.

- Segment and Target Right Customers

- Define Ideal Customer Profiles (ICPs)

- Customize Marketing Efforts for ICPs

- Balance Retention and Acquisition

- Maximize Existing Customer Value

- Reduce Churn Rates

- Leverage Marketing Technology

- Don’t Hesitate Using Marketing Automation Tools

- Implement CRM Systems for Lead Nurturing from Your First Day

- Experiment with Ad Creatives and Landing Pages

- Continuously Improve Conversion Rate

1- Segment and Target Right Customers

Efficient CAC begins by segmenting and targeting your customer base. Tailor your marketing efforts to specific customer profiles to reduce costs and boost conversions.

How to target and segment the right customers?…

No worries, just try to

- know your brand inside out

- analyze competitors

- run a servay on your existing pool of customers

- map your customer journey

- and leverage social listening and (or even) targeted advertising.

This will help you get a clear picture and map your target group of customers effectively.

2- Define Ideal Customer Profiles (ICPs)

Start by defining precise Ideal Customer Profiles (ICPs). These profiles should include all the details about-

- Demographics

- Behavior patterns

- Needs & wants

- Pain points

- Age group

- And Income

-of your customers

The more accurate your ICPs, the more efficient your marketing efforts will be.

3- Customize Marketing Efforts for ICPs

Once you’ve identified your ICPs, tailor your marketing strategies to resonate with them.

Craft personalized messages, select the most effective communication channels, and emphasize the benefits that matter most to these specific customer segments. This focused approach will lead to higher conversion rates and lower CAC.

Utilize both short-term (ads, partnerships, etc.) and long-term (content marketing) strategies.

Remember that Content Marketing is the key player for long-term success, especially for SaaS industries.

4- Balance Retention and Acquisition

Your priority is to lower customer acquisition costs, but it’s equally essential to recognize the value within your existing customer base. You need to maintain a balance between retention and acquisition strategies to ensure desired benefits.

Balancing retention and acquisition is crucial for long-term growth. To achieve this, you should-

- Understand your target audience segments

- Align brand goals with their preferences

- Diversify touchpoints

- Test and optimize your strategy

- And involve customers in brand development for a robust brand presence.

5- Maximize Existing Customer Value

Focus on extracting the maximum potential from each customer.

You can achieve this by upselling or cross-selling additional products, offering premium features, or expanding your product suite.

You already know that increasing the Customer Lifetime Value (CLV) offsets higher CAC, ensuring your profitability for a long time.

6- Reduce Churn Rates

Churn rate, or customer attrition, can harm your profits and lead to higher CAC.

Ensure real-time customer support, address their pain points, and consistently deliver value to maintain customer loyalty.

Try to personalize your onboarding process for new customers, increase customer engagement with in-app guidance, and gain insights into what drives value from existing customers. These tactics will help protect your profits and prevent CAC from rising.

7- Leverage Marketing Technology in The Right Way

Make the most of marketing technology tools to streamline your processes and enhance the efficiency of your CAC efforts.

There are lots of surprising tools available for every stage of your journey, from selecting a niche to conducting competitor analysis, performing keyword research, creating repurposing content, managing email marketing, and leads, running personalized ad campaigns, and tracking user journeys.

Start with Google products (like GA4, Search Console, Google Trends) and utilize SEO-CRM and user experience tools like SEMRush, Ahreafs, Spyfu, Hotjar, Hubspot, MailChimp, and others you need.

8- Don’t Hesitate Using Marketing Automation Tools

Marketing automation platforms (Email Marketing, content repurposing, programmatic ads) can help you in nurturing leads, sending personalized messages at scale, and tracking customer interactions.

By automating repetitive tasks, you can optimize your marketing campaigns and reduce resource-intensive efforts.

You can just double down your activities and efforts using AI-powered marketing automation tools.

9- Implement CRM Systems for Lead Nurturing from Your First Day

Customer Relationship Management (CRM) systems are invaluable for lead nurturing.

They allow you to track interactions with leads, manage customer data, and personalize communications.

A well-utilized CRM like Hubspot can lead to higher conversion rates and lower your CAC.

10- Experiment with Ad Creatives and Landing Pages

A/B testing involves creating variations of your ad creatives and landing pages to determine which versions perform best.

You can easily refine your marketing materials, enhance click-through rates, and reduce wasted ad spend.

A/B testing is a must to get better outcomes in the long run.

11- Continuously Improve Conversion Rate

Your conversion rate is a critical factor in CAC optimization. Analyze your conversion funnel, identify bottlenecks, and implement improvements.

Even small increases in conversion rates can significantly impact your CAC by reducing the number of leads needed to acquire a customer.

Why CAC Matters for SaaS Companies – Four Points to Remember

CAC is essential for SaaS companies – you already know that. Here are a few additional points to get a deeper look-

- Early Investment Reflection: CAC shows the big investments made in acquiring customers. It marks when these investments start paying off.

- Optimizing LTV/CAC Ratio: SaaS companies aim for a 3+ LTV/CAC ratio, showing efficient and profitable customer acquisition.

- Enhancing Payback Period: A shorter payback period means a quicker recovery of acquisition costs, especially important for SaaS businesses using freemium models.

- Tracking the CAC Ratio: The CAC ratio reveals overall profitability, emphasizing the importance of sustaining profits.

Customer Acquisition Cost Optimization: Examples and Case Studies

Let’s explore some real-world examples of SaaS companies that have successfully optimized their Customer Acquisition Cost or CAC.

HubSpot: HubSpot is renowned for its inbound marketing strategy. They create valuable content and offer free tools that attract and engage their target audience. By providing free CRM software and education through their academy, they’ve managed to significantly reduce their CAC over time.

Hubspot generates about 20M traffic each month through its content, all organically!

Salesforce: Salesforce is another SaaS giant that has excelled in CAC optimization. Salesforce employs account-based marketing, targeting high-value accounts and using personalized campaigns.

Salesforce is generating 10M+ organic traffic from their target areas.

This approach has led to a lower CAC and higher customer retention rates for both of these companies.

Hubspot and Salesforce CAC Optimization Strategies: Key Takeaways

Hubspot and Salesforce implement two key strategies to optimize their CAC:

- Content Marketing: Both HubSpot and Salesforce invest heavily in content marketing. They produce informative blogs, eBooks, webinars, and videos to attract and nurture leads.

- Free Tools (Freemium models): HubSpot’s free CRM and Salesforce’s free trials allow potential customers to experience their products before committing, reducing the friction in the acquisition process.

You too should focus on creating valuable content to educate your potential customers.

Offering free tools or trials can lower barriers to entry and provide a taste of your product’s value.

Also, targeting high-value accounts through personalized marketing efforts can lead to more efficient customer acquisition.

Tools for Customer Acquisition Cost Management

Effective CAC management often involves utilizing specialized tools and platforms:

Google Analytics and Search Console: This tool helps you track website performance, conversions, and visitor behavior, providing insights for optimization.

Customer Relationship Management (CRM) Software: CRM systems like Salesforce, HubSpot, or Zoho can streamline lead management and nurturing.

Marketing Automation Tools: Platforms like Marketo, Mailchimp, or HubSpot automate marketing campaigns, saving your time and resources.

SEO tools: SEO tools like Ahrefs or SEMrush or SpyFu help you track your organic growth, monitor competitors, and prepare planning for the future.

Future Trends in Customer Acquisition Cost for SaaS

In the future of SaaS CAC management, expect AI and machine learning to play a bigger role. Let’s explore it in short including a few other factors.

AI and machine learning applications

Artificial intelligence and machine learning will play a significant role in CAC management in 2024 and beyond. Predictive analytics will help identify high-value leads and tools like chatbots will enhance customer interactions.

Evolving customer behavior and its impact on CAC

As customer behavior evolves, so should your CAC strategies. More customers are researching online and seeking self-service options, so providing accessible information and support is crucial.

Regulatory changes like data privacy affecting CAC strategies

Data privacy regulations, like GDPR and CCPA, impact how you acquire and handle customer data. You should stay compliant to avoid legal issues that can affect your CAC.

FAQs

How should I calculate CAC in a B2B SaaS business?

Calculating customer acquisition costs (CAC) in B2B SaaS is like putting together a puzzle.

Let me walk you through it:

- Know Your Crowd:

- In B2B, clients come in all shapes and sizes. Treating them all alike won’t cut it.

- Who’s the Boss?

- Recognize that the one using your product and the one signing the checks might not be the same. Tailor your approach for both.

- Levels of Fancy:

- Some clients pay big, others start small. But often, the big shots bring in the most bacon. Balance matters.

- How You Sell Matters:

- B2B isn’t one-size-fits-all. Start small, show your worth, and climb up. Big sales may look good, but small starts can win the long game.

- Go with the Market Flow:

- B2B SaaS catches trends quickly. Getting in is easy; staying is the hard part. It’s not just about getting customers; it’s about making them stick.

- New Places, New Faces:

- Going into a new market is like opening a treasure chest. But if everyone already has your product, it’s a different game. Every market has its own rules.

- Don’t Trust Just Numbers:

- Numbers can lie. Don’t just chase the easy wins. Sometimes, the bigger wins are up high, waiting to be grabbed.

In a nutshell, calculating B2B SaaS CAC is about understanding your clients, balancing big and small, being flexible in how you sell, riding market waves, exploring new territories, and not falling for numbers that don’t tell the whole story.

It’s like figuring out a puzzle – challenging but totally doable!

How to estimate the CAC without knowing the total number of acquired customers?

Estimating CAC (customer acquisition cost) without knowing the exact number of acquired customers is really challenging. Most companies (including publicly traded companies) don’t disclose this information for competitive reasons.

Anyway, there are some strategies and best practices to derive insights into CAC from financial statements:

- Marketing Spend and Growth Trends: Analyze trends in marketing expenses over specific periods and correlate them with overall revenue growth. While not precise, increasing marketing spending usually indicates an effort to acquire more customers.

- Sales and Marketing Ratios: Evaluate sales and marketing expenses as a percentage of revenue. A rising ratio may suggest increased investment in customer acquisition efforts.

- Customer Lifetime Value (CLV) vs. CAC Ratio: Compare the ratio of Customer Lifetime Value to CAC. If this ratio is healthy and growing, it implies efficient customer acquisition relative to the value those customers bring over time.

- Management Discussions and Analyst Reports: Examine management discussions in annual reports or analyst reports, where companies might provide insights into customer acquisition strategies without disclosing specific numbers.

These methods provide some estimation but keep in mind that they are indirect indicators. You can’t guarantee 100% accuracy in such calculations.

Final Words on Customer Acquisition Cost for SaaS Companies

Understanding and optimizing Customer Acquisition Cost (CAC) is essential to ensure desired profit and growth.

CAC is the total cost of gaining a new customer, including sales, marketing, and other expenses. This article provides practical insights into CAC, covering its calculation, importance, and improvement strategies.

For tech startups, especially in SaaS, CAC is essential. Calculating CAC is simple, but real-world situations may require experimentation in some cases based on your niche and project. There’s no magic number, but your CAC should be lower than your Customer Lifetime Value (LTV).

Top factors affecting CAC include marketing, sales, product complexity, competition, and customer segmentation. Handling long sales cycles can be tricky but it’s necessary.

Learn from real examples, keep an eye on your competitors, and use tools like Google Analytics and CRM software. Don’t forget to adapt AI and change customer behavior.

These are the keys to your success in 2024 and beyond.

Did I miss something?

Don’t forget to share your thoughts in the comment section below!

Leave a Reply